These questions relate to Keele University’s Financial Sustainability Plan and the accompanying Frequently Asked Questions.

1. What is the reason for the sudden announcement of 150 job losses?

The University accounts for 2017/8 report an operating surplus of £7m and state that ‘The budget for 2018/9 and forecasts for subsequent years show that the University will continue to generate surpluses and have adequate available financial resources’ [1, p.8].

In July 2018 the University set an ambitious budget to make a record operating surplus of £12m in the year 2018/9. After the first quarter of 2018/9 it became clear that this was not going to be achieved; the current forecast is that the surplus will be around £8m. Although this sounds healthy, on a cash-flow basis the University’s financial position is much less good (see Q3,4 below).

This triggered a round of drastic cuts to capital spending projects and the announcement of a Financial Sustainability Plan, involving income growth, efficiency savings, and the loss of 150 jobs, aimed at making savings of £8m per year.

2. What is the cause of the shortfall against the budget?

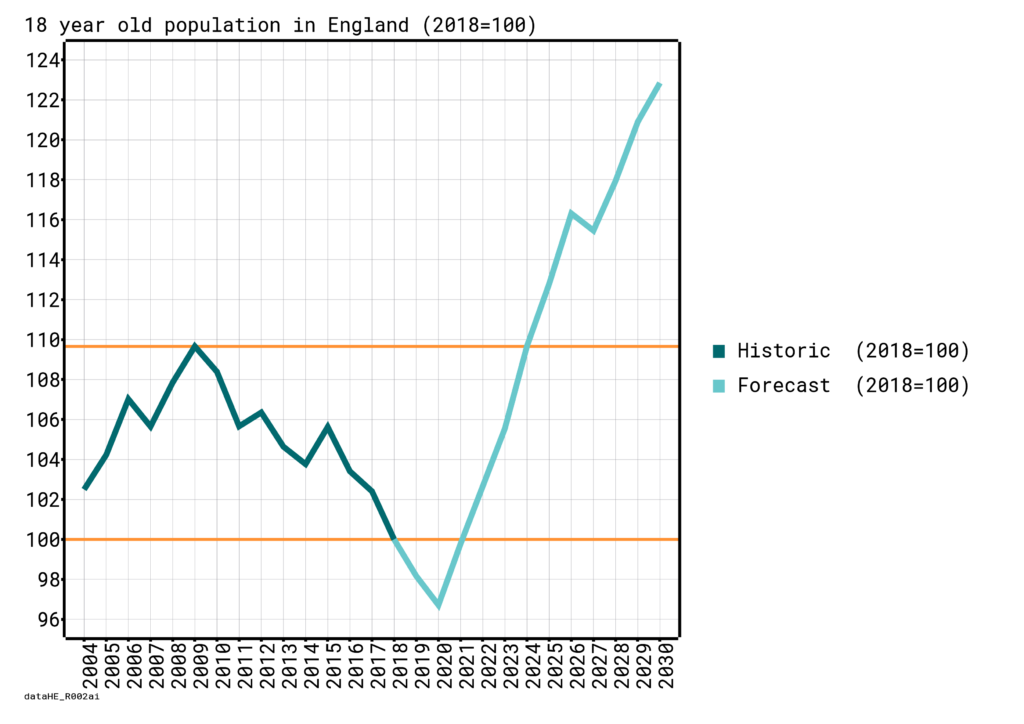

The planned growth in student numbers was not achieved. Student numbers increased very slightly from last year, which is not bad given the decline in the number of 18-year-olds in the population [5]. Tuition fee income went up a little, but not as much as expected. Other forms of income went up more than expected, leaving total income almost exactly on budget.

There was a large overspend under the headings of ‘other operating expenses’ and ‘staff costs’ (which include pay, among other things). The nature of this overspending has not yet been explained to us. It certainly has nothing to do with staff salaries: pay rates, national insurance rates and pension contribution rates are exactly as expected when the budget was set, and there are slightly fewer staff than budgeted for.

3. Is the University in deficit?

Not on any fair measure known to us.

There are many ways of measuring the University’s financial position, for example the surplus of income over expenditure [table 1, column D]. However, the view of University management is that ‘net cash flow from operating activities’ is the best measure of the underlying position. The vice-chancellor’s FAQ quotes the past three years’ figures (over which the cash flow surplus has fallen) and comments:

‘There is a simple explanation for this trend in declining cash flow surpluses: Income generation from tuition fees has slowed, while costs, particularly payroll costs, have continued to increase.’ [2]

This is a highly manipulative use of data. As table 1, column E, shows, the ‘trend’ is simply the latest wiggle in a very irregular curve. On the whole the University’s position has improved greatly on this measure over the past 20 years.

Moreover, the fall in the cash surplus over the past three years is not due to staff costs rising faster than tuition fees: tuition fees actually rose faster than staff costs.

(It should be noted that the accounting system changed in 2015, and this distorted the calculation of staff costs particularly; figures for 2014/5 under the old and new system are given in table 1, rows 24-25. The change creates the illusion of a sudden jump in staff costs at this time.)

The vice-chancellor further claims that ‘the level of cash surplus generation by the University, relative to income, has halved over the last 15 years’ [3]. It is difficult to reconstruct his calculation: cash surplus as a proportion of income was -4% in 2001/2, -0.1% in 2002/3, 5.3% in 2003/4, 1.8% in 2017/8.

4. Does the University need a cash surplus?

The University must make a cash surplus from its operations to pay for investments in new buildings, facilities and new initiatives. However, these investments are financed by bank loans, so what this means in practice is that the University must make a sufficient operating surplus to cover its loan repayments and interest repayments.

The forecast net cash inflow from operations for 2018/9 is about enough to cover the University’s financing activities (loan repayments and interest paid minus investment income).

It is desirable to make a larger surplus than this to cushion the University from financial shocks such as a bad recruitment year, an adverse change in the higher education funding regime following the Augar review, etc.

5. Is student recruitment a problem?

The population of 18-year-olds has been shrinking since 2009 but is due to increase sharply from 2020 onwards [5]. In the face of this Keele has done well to increase its student numbers by 22% since 2015, taking full advantage of the lifting of the student numbers cap. Recruitment and retention in 2018 were below target, but student numbers were still slightly up on the previous year, indicating that the intake must have been similar to three years ago.

The population of 18-year-olds will grow by about 3% per year from 2020, recovering to the 2018 level in 2021.

One would expect that the dominant theme of the University’s planning would be how to weather the current demographic dip and take advantage of the coming period of sustained expansion; but one looks in vain for any such discussion in the University’s official documents. Instead, jobs are being cut as if the demographic decline were to be permanent. The danger is that cutting staff in 2019 will leave unplanned holes in our teaching provision, leaving us poorly positioned to expand from 2020 onwards.

6. Are inflationary staff costs the problem?

The vice-chancellor’s presentations and FAQ repeatedly highlight rising pay costs as a problem.

‘Next year we already know that pay costs will increase by around £3m per year and that we will have £1.6m less in income due to higher than budgeted levels of student withdrawals this year. This will reduce operational cash flow by £4.6m. Without any plan we would therefore have a negative cash flow, where our activities cost more than the income they deliver.’ [2]

This is a highly selective calculation. Staff costs do indeed go up by about £3m per year, but everything else goes up too. Staff costs, which were 60-65% of income before 2010, have fallen to 52-55% of income and the percentage is stable [table 1, column G]. Pay rates have consistently fallen behind inflation over the past ten years; the University has become accustomed to relying on ever-declining staff living standards to balance its books.

7. Do annual pay increments and promotions increase the salary bill?

Every year some staff are promoted to a higher grade and some others move up one salary point. Management repeatedly makes the claim that this pushes up the total salary bill every year. This is completely spurious. Every year, while some staff are moving up the scale, senior staff are retiring and being replaced by junior staff at the bottom of the scale. There is thus a steady state, with an approximately constant proportion of staff at each salary point. The annual rise in the salary bill can be well explained by two factors: the annual pay rise and the change in the total number of staff.

8. Have top salaries risen?

In 1996/7 The vice-chancellor’s salary was £83,000; in 2017/8 it was £279,000. This is an average increase of 6% per annum – far in excess of general pay rises. It has been obvious for many years that this is the one area of University expenditure that is not subject to financial discipline.

9. Does the University have a heavy debt burden?

In 2017 the University received a very large loan of £45m from Barings Bank, to be repaid in two halves in 2037 and 2042. The interest rates (3.27% and 3.37% for the two halves) are quite favourable. Most of the loan is to be used for the new Central Science Laboratories and the Smart Innovation Hub.

This loan increases the University’s total debt from £33.6m to £72.7m [1, note 20]. On top of this is the Keele Residential Funding scheme, which is equivalent to a debt (see Q10 below). Debt servicing costs around £5m per year, of which £1.5m is interest on the Barings loan. In addition, money must be set aside to repay the Barings loan in 2037 and 2042.

This is undoubtedly the reason for the current management concern with increasing the cash surplus.

10. How has the Keele Residential Funding scheme affected the University?

Keele Residential Funding (originally known as Owengate) is a financing scheme that began in 2000, when the University received a lump sum of £55.4m, with a further lump sum of £48.3m in 2007 when the scheme was extended; some of this money is committed to refurbishment of student halls of residence. In return the University must hand over its hall rental income until the year 2047. The scheme is therefore functionally equivalent to a loan, albeit on very unfavourable terms, but is not shown as debt on the balance sheet.

It was entered into in order to replace existing loans. The University was at its borrowing limit; this ‘financial restructuring’ allowed the University to disguise its debts and borrow more.

This scheme is not the same as the notorious Private Finance Initiatives of the 1990s, but it has some points of resemblance to them, namely (i) poor value for money, (ii) the appearance of money being magicked out of nowhere by clever ‘financial engineering’, (iii) a heavy financial burden for future generations, (iv) the University retains all financial risks, (v) a cloak of commercial confidentiality prevents proper scrutiny of the finances, (vi) secretive and questionable decision-making processes, and (vii) the University loses control of the setting of hall rents.

In our view Keele Residential Funding was a major blunder that will drain the University of money for many years to come [6,7,8]. The senior staff responsible have all moved on, but we bear the costs.

11. Has the University spent too much on buildings rather than staff?

There is cause for concern about the balance of spending as between buildings and staff.

Since the cap on student numbers was lifted, universities have vied with one another to attract students by putting up shiny new buildings. Keele has taken a full part on this, perhaps beyond its means as a small university. Even after the recent cuts, the University is spending over £30m on capital projects this year. No doubt future expansion will require new facilities, but it is hard to see the point of a new building if the staff to work in it are being made redundant.

Perhaps the problem here is that when money is spent on a new building it shows on the balance sheet as an asset, whereas money spent on employing staff shows in the accounts purely as a cost. From the accounting point of view, a well-trained and dedicated workforce is an invisible asset; in real life it is the core of the university’s success.

12. Is Keele in a worse position than other universities?

Figures on all universities are collected nationally by the Higher Education Statistics Agency [4]. Keele’s position is mid-range on most of HESA’s financial indicators. The two indicators that give cause for concern are

- the amount of external borrowing, which as a result of the Barings Bank loan has suddenly risen to 43.69% of income (39th place from the top out of 165 higher education institutions);

- net cash flow from operating activities, which is comparatively low, at 1.76% of income (13th place from the bottom out of 165).

13. What will be the effects of the job cuts on students?

There will be more students and fewer staff to teach them.

There is a great deal of talk in University plans about ‘Digital Education’ and an ‘efficiency dividend’. We have been receiving clear indications that this will include delivering courses through a mixture of recorded lectures and live lectures, thus allowing more modules to be delivered by a given number of staff. This will change the model of education to one with a lesser element of human contact.

References

[1] Keele University accounts, https://www.keele.ac.uk/finance/accounts/

[2] Keele University FAQ, What is the difference between our published surpluses and our underlying financial position?, https://www.keele.ac.uk/intranet/our-future/faqs/

[3] Keele University FAQ, Why does the University need to make a cash surplus?, https://www.keele.ac.uk/intranet/our-future/faqs/

[4] Higher Education Statistics Agency, Key Financial Indicators, https://www.hesa.ac.uk/data-and-analysis/finances/

[5] Graph of numbers of 18-year-olds, from Mark Corver, ‘The great recruitment crisis: planning for rapid student number growth’, 18/3/19, https://wonkhe.com/blogs/the-great-recruitment-crisis-planning-for-rapid-student-number-growth/

[6] The Owengate “Financial Restructuring” deal, Keele AUT Briefing, March 2003.

[7] Costs and benefits of Owengate, Keele AUT Briefing, June 2003.

[8] P. Armstrong & P. Fletcher (2004) Securitization in public sector finance. Public Money & Management, vol. 24(3), 175-82.

Last revised 03/06/19